Banks’ risk reduction

is a prerequisite for a common

deposit insurance scheme

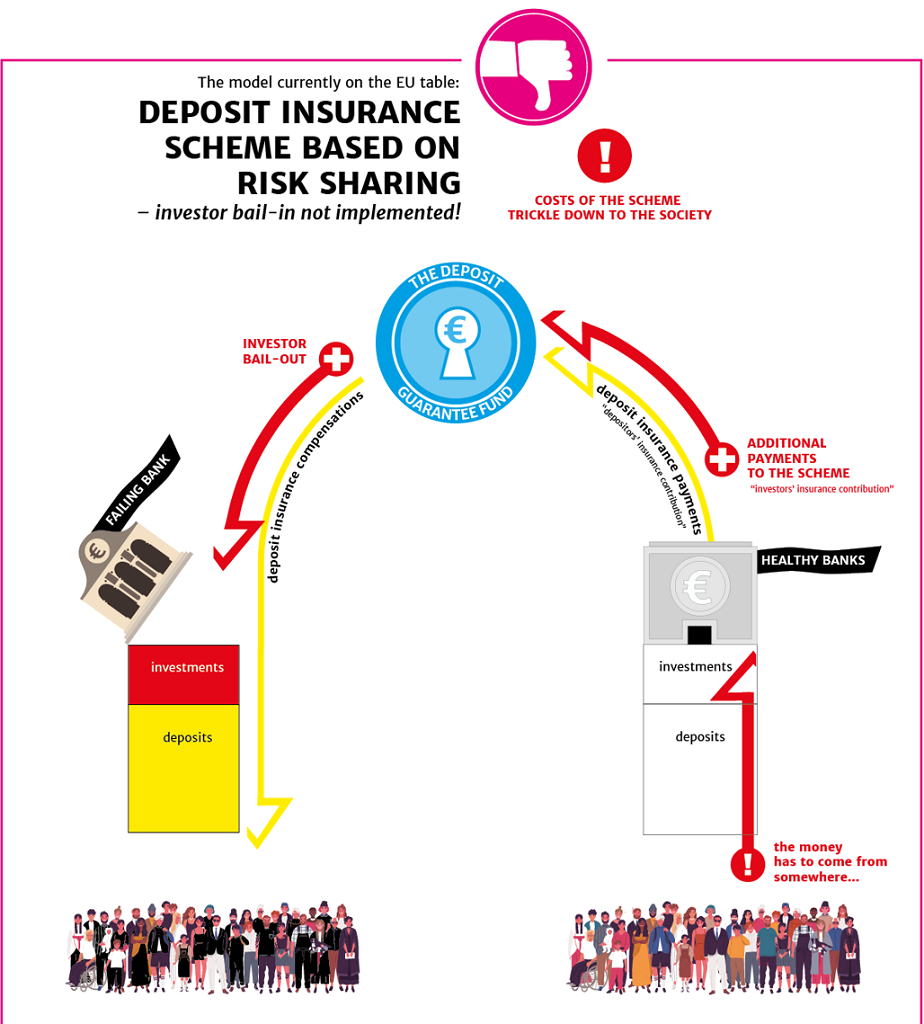

Every member state’s own banking system as well as every individual bank must reach a healthy financial status before risk sharing can be increased with mechanisms such as the deposit insurance scheme.

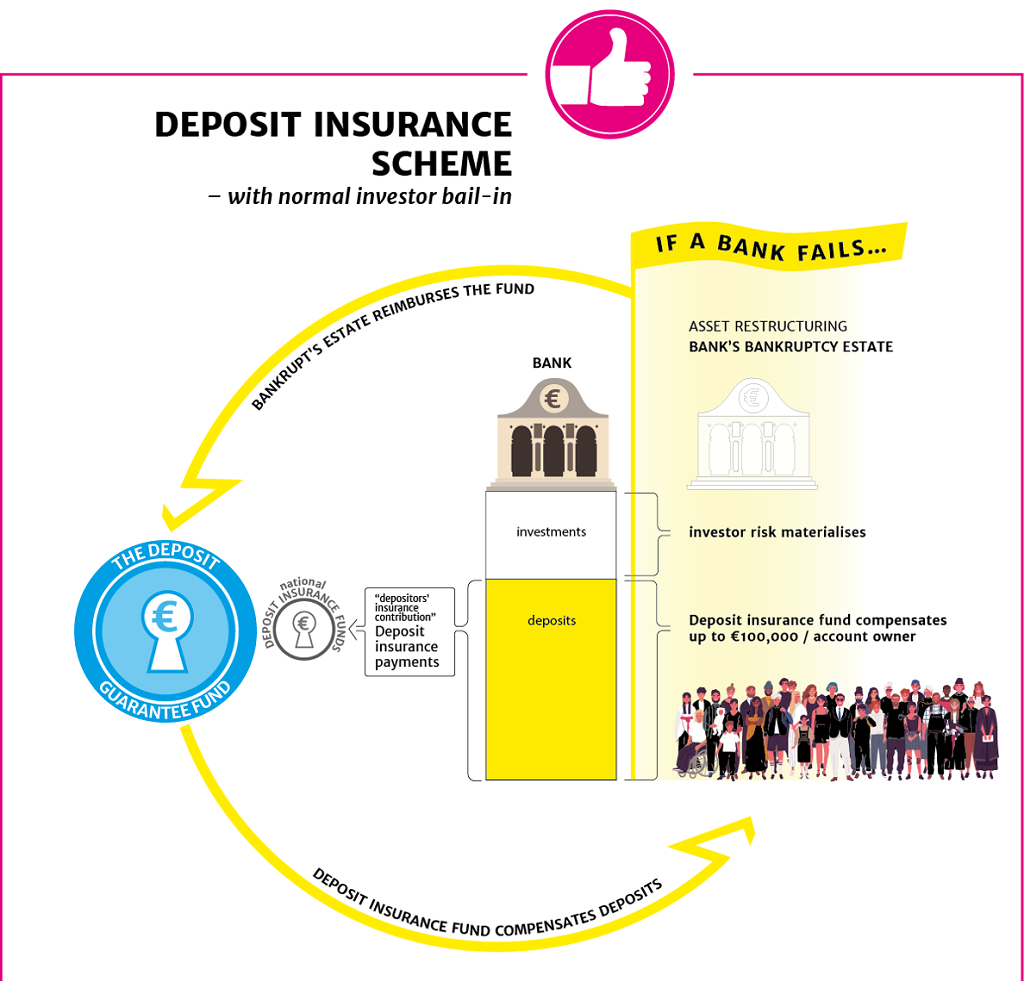

FFI strongly supports the idea of deposit insurance and deposit guarantee funds. The scheme must be designed so that compensations are available at need and distributed fairly.

Until risk reduction in the Banking Union is complete, the current model based on national deposit insurance schemes is a good option for Finland.

The preparation of the Banking Union’s common European Deposit Insurance Scheme (EDIS) has been sped up as of late. At the moment, Banking Union member states have single banking supervision and a single resolution mechanism, but deposit insurance is implemented at national level in line with the EU Deposit Guarantee Schemes Directive. The DGSD lays the foundation for harmonised deposit insurance.

There are several unhealthy banks in Europe, typically small in size. Should these banks fall insolvent as a result of the pandemic, for example, there is a risk that their estates will not have sufficient funds to reimburse the compensations paid out from a common deposit guarantee fund.

One gauge of difficulties is the level of non-performing loan exposures. Totalling about €500 billion in the EU before the pandemic hit, they are now expected to rise, with differences between countries also likely growing. In Finland, non-performing loan exposures amount to only 1.5% of all bank exposures.

Arguments in favour of an EDIS often bring up depositor protection and prevention of contagion risk. However, when national deposit guarantee schemes are taken into account when examining the solvency and crisis management frameworks, depositor protection is already in place.

Banking does not take place in a void. Banks need to raise the necessary funds to pay their guarantee fund contributions. In the corporate world, there are two ways to do this: improving efficiency or increasing revenue. The payments into a common deposit insurance scheme thus directly influence banks’ operations also competitively speaking.

Filter

Still have questions?

|Contact FFI experts