- The Finnish deposit guarantee scheme safeguards bank customers’ deposits to a maximum of €100,000. If a deposit bank is declared bankrupt or is in permanent default, the bank’s depositors are paid compensation.

- Finland has a decades-long tradition of protecting depositors. The modern deposit guarantee is a statutory scheme, maintained by the Financial Stability Authority.

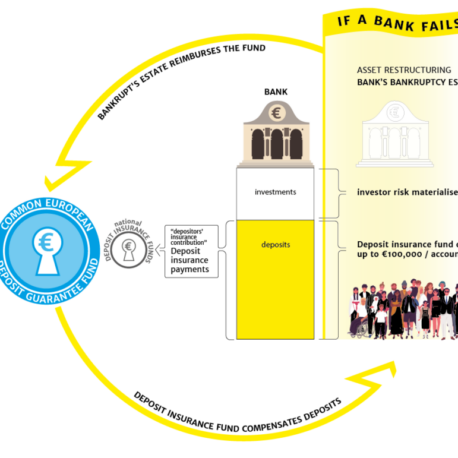

- The deposit guarantee is financed by deposit banks. They pay deposit guarantee contributions to the Deposit Guarantee Fund.

The deposit guarantee schemes of EU Member States have been harmonised with the EU Deposit Guarantee Scheme Directive. Finland already had a strong national deposit guarantee scheme before the directive was enacted. There have also been plans to implement a European Deposit Insurance Scheme (EDIS), in which the member states of the EU Banking Union would be collectively responsible for deposits in all of the countries. These plans have not been taken forward yet. Finance Finland does not think risk sharing in the Banking Union should be deepened until the present problems of each member state’s banks are solved and their risks reduced.

The deposit guarantee scheme was created to safeguard depositors’ assets and increase the stability of the banking system. If a Finnish deposit bank is declared bankrupt or is in permanent default, the Financial Stability Authority pays compensation to the bank’s depositors from the Deposit Guarantee Fund.

When customers can trust that their deposits are safe, they do not need to fear they might not get their money back if the bank runs into problems. Without deposit guarantee, customers would rush to withdraw their deposits if the bank’s solvency was in doubt. This mass withdrawal would further impair the bank and trigger a bank run, which would eventually bankrupt the bank.

The deposit guarantee scheme covers all deposits by private persons as well as most deposits by companies, associations and foundations. The deposit guarantee is bank-specific: if a depositor has accounts with multiple banks, the €100,000 maximum compensation amount applies to their deposits in each bank. Assets obtained from the sale of a residence are covered in full if the assets were deposited on the account no more than six months before the bank became insolvent and if they are intended for the purchase of a new residence for the depositor’s own use.

The Finnish deposit guarantee scheme is run by the Financial Stability Authority, which operates under the Ministry of Finance. It manages the Financial Stability Fund, which consists of two separate funds: the Resolution Fund, financed by contributions paid by investment companies, and the Deposit Guarantee Fund, financed by deposit guarantee contributions raised from banks.

Still have questions?

|Contact our experts