- The Deferred Tax Recapture Rule included in the Pillar 2 (minimum tax) poses a potential disadvantage for leasing companies in the Nordics.

- The exemption of the Deferred Tax Recapture Rule should be amended to also include the deferred tax liability on leased assets on the lessor side when the underlying asset constitute fixed assets.

- The Nordic assocications appeal to the OECD to change its guidelines.

Introduction

The Pillar 2 GloBE rules came into effect at the beginning of 2024. Under the Pillar 2 GloBE rules, certain deferred tax liabilities are subject to recapture. The Deferred Tax Recapture Rule poses a potential unreasonable and, in our view unintended disadvantage for leasing companies in the Nordics. We believe that putting one industry at a disadvantageous situation compared to others has not been the purpose of the Pillar 2 regulation, and we are of the opinion that the OECD guidelines/administrative guidance should be amended in this regard.

Below, we outline the issue that leasing companies in various Nordic countries are facing regarding the impacts of the Deferred Tax Recapture Rule as well as our proposed solution.

Pillar 2 Deferred Tax Recapture Rule for financial lease at the lessor side

According to the Article 4.4.4 of the Pillar 2 GloBE rules certain deferred tax liabilities are subject to recapture. This means that if they are not fully utilized within 5 years, the outstanding deferred tax liability is clawed back in the original years of the GloBE effective tax rate calculation. If deferred tax is recaptured, the profit and loss credit is effectively transferred to the year the deferred tax liability was created, reducing the tax charge, and potentially creating or increasing top-up tax payable for that year.

According to IFRS 16, financial leasing agreements are reported in the balance sheet as a receivable from the lessee (which decreases during the lease term). However, according to the national accounting rules (local GAAP) Finland and Sweden, as well as for small companies in Norway, and tax legislation in the Nordics (Finland, Norway and Sweden), the leased property is regarded as a fixed asset subject to depreciation. IFRS, the local accounting rules and tax rules applied to fixed assets in the Nordic countries are as follows:

| Finland | Accounting | Local GAAP: Deprecation over the period the asset is used IFRS: depreciation over lease term |

| Taxation | Depreciation: 25% residual value | |

| Norway | Accounting | Local GAAP for small companies: depreciation over the period the asset period the asset is used IFRS: depreciation over lease term |

| Taxation | Depreciation: 10-30% residual value | |

| Sweden | Accounting | Depreciation over the period the asset is used |

| Taxation | Simplified, 30% declining balance or 20% straight-line |

The different treatment of financial leasing results in a deferred tax liability (DTL) for differences between IFRS and local GAAP, IFRS and taxation as well as local GAAP and taxation. The assets are depreciated on an aggregated basis, meaning that it is difficult – and to some extent in practice impossible – to trace a deferred tax liability to a certain asset.

Leased property is often leased for a period exceeding 5 years (20 – 40 years’ lease periods are not exceptional) and in addition, a lease agreement often includes an option to extend the lease period (e.g. 5 years + an option of additional 3 years). Lease periods exceeding 5 years lead to a decrease in income tax cost in the GloBE calculation and thus very likely into top-up tax impacts. The effective tax rate calculated according to GloBE rules may decrease under 15% solely due to the use of the Deferred Tax Recapture Rule on DTL on differences in IFRS/local GAAP/taxation valuation on leased property.

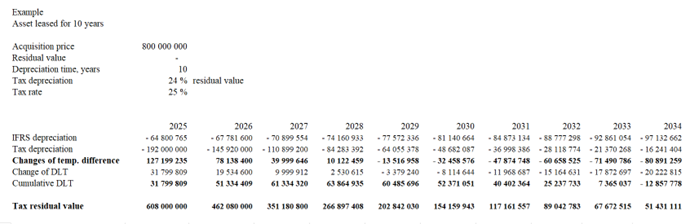

Typically, leasing companies have a huge number of financial leasing contracts. There can be tens or hundreds of thousands of assets leased. At the end of each lease period, the assets are sold and typically, most of the deferred tax liability is discharged at the end of the rental period. The below examples show how the deferred tax liability is formed, reduced and then, at the end of the lease period, discharged.

The Deferred Tax Recapture Rule has turned out to be a severe problem for leasing companies in the Nordics. The impact of this rule threatens to create significant top-up tax impacts for these companies. We firmly believe that this was not the intention when drafting the Pillar 2 GloBE rules. It is also important to note that there is no corresponding issue on the lessee side, as the exemption to the Deferred Tax Recapture Rule applies to leased income for lessees. To avoid unintended consequences of the Deferred Tax Recapture Rule, the mentioned exemption should also apply to lessors.

Suggested solution

The exemption of the Deferred Tax Recapture Rule (Article 4.4.5 of the Pillar 2 GloBE rules) should be amended to also include the DTL on leased assets on the lessor side when the underlying asset constitute fixed assets.

Conclusion

We kindly request that the OECD delegates from our countries raise this issue within the OECD and advocate for changes in the GloBE regulations/OECD administrative guidance. This will help address the unreasonable and unintended consequences of the Deferred Tax Recapture Rule for leasing companies in a timely manner.

For more information, please contact:

- Marja Blomqvist, Head of Tax Regulation, Finance Finland, marja.blomqvist@financefinland.fi

- Herborg Horvei, Principal Advisor, Finance Norway, herborg.horvei@finansnorge.no

- Katrin Fahlgren, Senior Legal Advisor, Swedish Bankers’ Association, katrin.fahlgren@swedishbankers.se