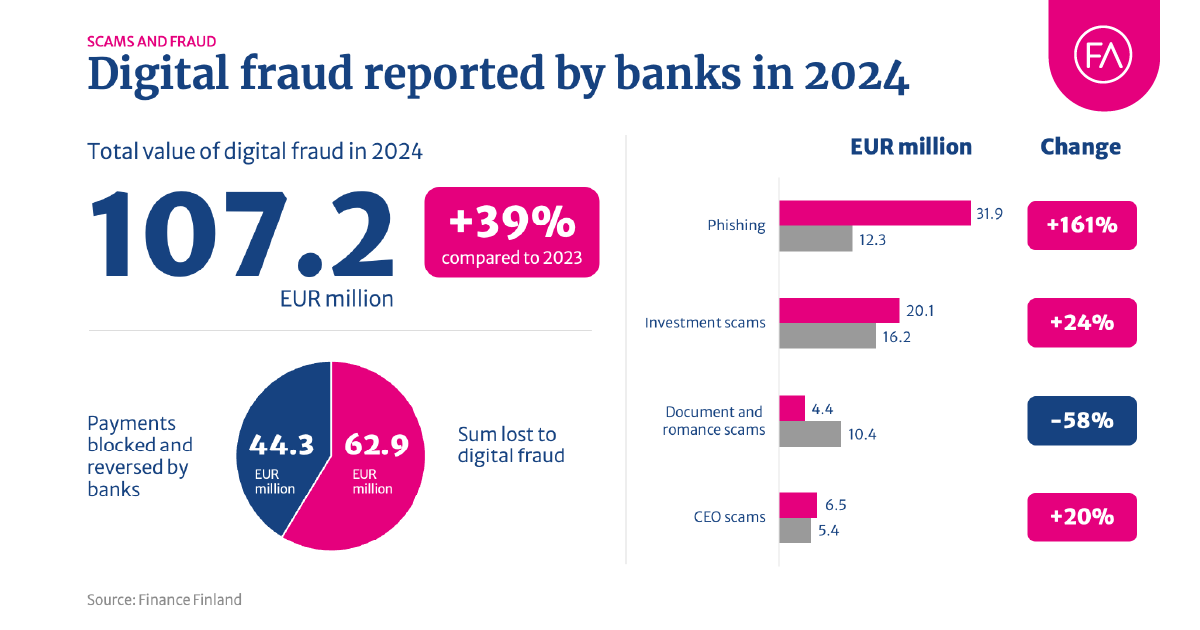

- In 2024, the total value of attempted fraud in Finland reached €107.2 million, shows bank data compiled by Finance Finland. In 2023, the value of attempted fraud was €76.9 million.

- Banks were able to stop or reverse a total of €44.3 million that was about to be transferred to criminals. This is 35% more than the year before. Finns still ended up losing €62.9 million to fraud.

- Finns’ heaviest losses came from phishing, which grew exponentially by 161% compared to the previous year.

- Public awareness and fraud literacy is key to preventing fraud. Another key factor is efficient information exchange. Banks’ exchange of information with other banks and the authorities needs to be improved.

The volume of attempted digital fraud grew considerably in Finland in 2024. Finns fell victim to fraud attempts for a total value of €107.2 million. This is an increase of 39% compared to 2023. Out of this total amount, banks were able to stop or reverse €44.3 million of fraudulent transactions to scammers.

The biggest losses resulted from phishing and investment scams. In 2024, a total of €31.9 million was lost to phishing and €20.1 million to investment scams.

The amount of romance scams decreased noticeably according to banks’ statistics. However, this can be attributed to differences in statistical classification, as certain types of romance scams have later been reclassified as investment scams. In these types of fraud, the romance scammers can tempt their victims with ‘investment opportunities’ that later prove to be fake.

Banks are working relentlessly, but fraud prevention requires joint effort from us all

Banks make sure to stay on the cutting edge of fraud prevention, but they are fighting a tough battle against increasingly clever and constantly evolving fraud methods. Finance Finland’s Head of Security and Loss Prevention Niko Saxholm points out that prevention alone cannot fully stop digital fraud, no matter how efficient it is.

“Banks’ ability to exchange information with each other and with the authorities should be significantly improved. Current legislation sets too many limitations in this respect. Efficient information exchange is the best way to nip fraud in the bud. But by staying alert, we can all reduce our individual fraud risk”, Saxholm says.

Phishing scams grew at an alarming rate in 2024. Saxholm says scammers today use more and more diverse phishing methods such as phone calls in which they claim to be police officers or bank employees.

Saxholm emphasises that if you feel pressured to react quickly, it is important to pause to think: scammers typically seek to create a sense of urgency.

“You should be very cautious especially when you’re confirming payments and transactions. It’s vital to check the authenticity and recipient of the confirmation request to make sure your funds aren’t transferred to fraudsters by mistake”, Saxholm says.

Saxholm points out that although banks are working relentlessly to prevent fraud, reaching a more enduring solution to the problem requires joint effort from the whole of society. Telecom operators are rendering valuable help by blocking scam calls, but it would be vital to also involve the social media giants, online marketplaces and other service providers through which fraudsters approach their victims with fraudulent ads, for example.

Saxholm reminds everyone that advertisements in general should be approached critically. Investment, in particular, should never be undertaken on the basis of ads alone.

“If you’re interested in crypto investment, for example, never jump in head first through an online ad. Instead, take the time to consider the matter and research information from several sources”, says Saxholm.

Contact your bank without hesitation if you suspect you have been defrauded

In May 2024, Finance Finland launched an anti-fraud campaign with the slogan Stick it to the scammers – Catch on to fraud before it catches you. The aim of the still running campaign is to remind Finns that anyone can be targeted by fraud regardless of their age, gender or profession. The campaign encourages anyone who suspects they have been defrauded to contact their own bank and the relevant authorities without hesitation.

Anyone can fall victim to fraud ‒ there is no need to be ashamed of it. Reach out to friends and family and seek professional help, if necessary.

Visit the campaign website at Huijaamaton.fi.

Rules of thumb – Keep at least this in mind

- Be wary of any links you receive in an e-mail or text message. Don’t click on any suspicious links. Never use your banking credentials to log into a website you opened through a link someone sent you.

- Don’t disclose your online banking credentials or passwords to anyone. Remember that your bank or the authorities will never ask for your banking credentials and that they have no need for them.

- Your online banking credentials are meant for your personal use only. Don’t give them out to anyone.

- Never use a search engine to access the e-services of banks, public institutions and authorities, such as the post office, the tax authority, the police, etc.

- Always make sure you’re visiting the real website by manually typing in the full URL address or by using the service provider’s mobile application.

If you suspect you have been defrauded

- First and foremost, call the Finnish banks’ 24/7 blocking service or your own bank’s customer service to block access to your card or account. Quick action can prevent or at least mitigate damages.

- Report the offence to the police.

- Don’t suffer alone. Anyone can fall victim to fraud ‒ there is no need to be ashamed of it. Reach out to friends and family and seek professional help, if necessary.

Still have questions?

|Contact our experts

Looking for more?

Other articles on the topic

Finnish financial sector and authorities tested their ability to operate under severe disruptions and emergency conditions

Fraud must be tackled at the source – Social media platforms and online marketplaces need to be involved in fraud prevention

Volume of digital fraud skyrockets in Finland – Banks blocked more than €44 million’s worth of fraud-related payments in 2024

The Commission must tighten the screw on fraud prevention – Social media platforms and online marketplaces must also be involved