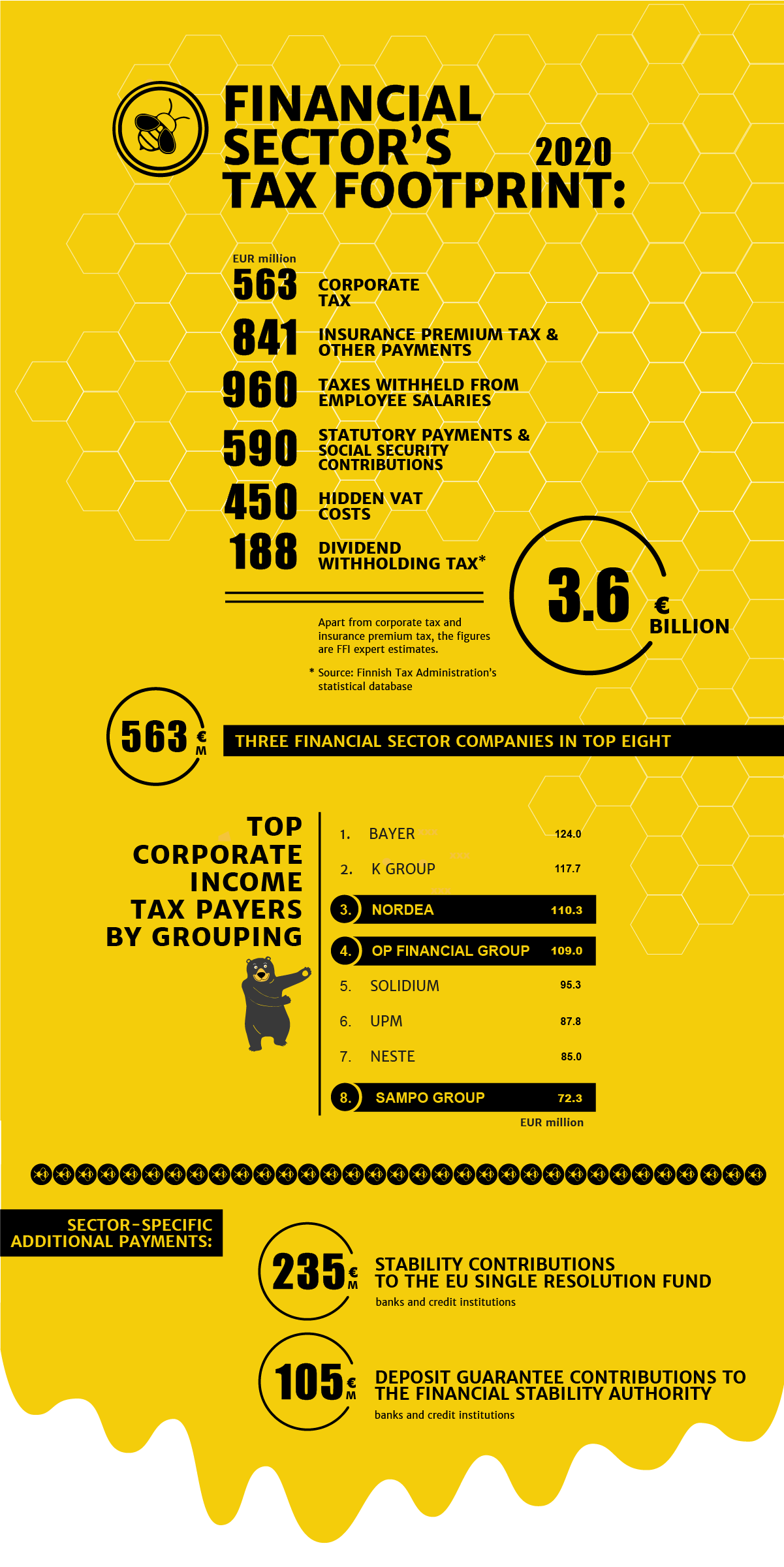

The financial sector was once again one of the biggest taxpayers in Finland according to 2020 tax data released by the Tax Administration. The top eight payers of corporate tax in Finland included three financial sector companies: Nordea (ranking 3rd), Op Financial Group (4th) and Sampo Group (8th). In total, the sector paid €563 million in corporate tax, amounting to about 10.3% of all corporate tax in Finland. This was €91 million less than in 2019.

The Finnish financial sector’s tax footprint is about 3.6 billion euros. The sector pays corporate tax (€563 million), insurance premium tax (€820 million), and contributions towards fire protection, road safety and industrial safety (€21 million). Moreover, the sector generates employee income tax (€960 million), social security contributions (€590 million) and dividend withholding tax (€188 million) and pays hidden VAT costs of €450 million.

Tax footprint nearly three times the costs of basic transport infrastructure management

The Finnish financial sector’s annual significant tax footprint would cover, for example, the budget of the country’s basic transport infrastructure management for two and a half years. The sector employs approximately 42,000 people.

The amount of the dividend withholding tax is based on statistics compiled by the Tax Administration. The figures reflect the European Central Bank’s 2020 recommendation that euro area banks refrain from paying dividends. Apart from corporate income tax and insurance premium tax, the other figures are FFI expert estimates.

The economy needs a strong and well-functioning financial services sector

Throughout the coronavirus pandemic, the Finnish financial sector has been able to support the economy towards recovery and the green transition. The banking sector’s strong capital position has enabled it to offer flexible loan arrangements to households and businesses, many of which needed them especially in the early days of the pandemic. New lending has also continued strong.

“Banks and insurers have been among the biggest taxpayers in Finland for a long time, thus also financing the welfare society. The sector is best able to promote growth and employment when its taxation and regulation are kept in moderation. New taxes would weaken the Finnish financial sector’s competitiveness and ability to act as a motor of growth”, says Finance Finland’s (FFI) Head of Taxation Lauri Luukkonen.

Largest payers of corporate tax in the financial sector

Finland’s top corporate taxpayer in 2020 was Bayer (€124 million), followed by K Group (€117.7 million) and Nordea (€110.3 million). In the financial sector, the top payers after Nordea were OP Financial Group (€109 million, 4th place), Sampo Group (€72.3m, 8th) and LocalTapiola (€38.1m, 16th). Danske Bank paid corporate taxes to a total of 25 million euros. FFI compiled the financial sector data based on public information provided by the Finnish Tax Administration. The figures of other sectors have also been calculated at group level.

Hidden VAT costs of €450 million

Financing and insurance services are exempt from value added tax according to the EU VAT directive. This exemption is based on the difficulties of defining the tax base and technical implementation, and on reasons of international competition.

Unlike most companies, financial sector companies cannot deduct the VAT for the goods and services they purchase. The sector thus bears a hidden VAT burden compared to companies that sell services which are subject to VAT. FFI estimates this VAT amounted for approximately €450 million in 2020.

“The financial sector is best able to promote growth and employment when its taxation and regulation are kept in moderation.”

LAURI LUUKKONEN, Head of Taxation

The non-deductible VAT raises prices compared to a scenario where companies could deduct VAT from their purchases. The VAT exemption is thus beneficial only for individual retail customers, whose prices for services are lower. In this light, the claim that the VAT exemption causes the sector to be undertaxed is false.

EU stability contributions of €235 million

In addition to the national taxes and contributions, Finnish credit institutions paid stability contributions to the EU Single Resolution Fund for €235 million. In 2021 the stability contributions will rise to €270 million. This is an increase of about 15% compared to 2020.

Sources used in the calculation of the sector’s tax footprint: Finnish Tax Administration, Statistics Finland, companies’ financial statements, KPMG, FFI.

Looking for more?

Other articles on the topic

Financial sector’s VAT treatment needs an overhaul, but the Finnish pension system must not be hampered with added tax burden

The Nordic financial sector calls for harmonised implementation of the FASTER Directive

Income taxes paid by financial sector companies grew to €1.3 billion in 2023, and the sector’s total tax handprint of €5.6 billion would cover Finland’s military expenditure – OP Financial Group and Nordea the two largest taxpayers in Finland

Finance Finland proposes ways to increase economic growth and tax revenue: Finnish law must provide for retail ELTIFs