- The financial sector was once again one of the biggest taxpayers in Finland according to the 2022 tax data released by the Tax Administration.

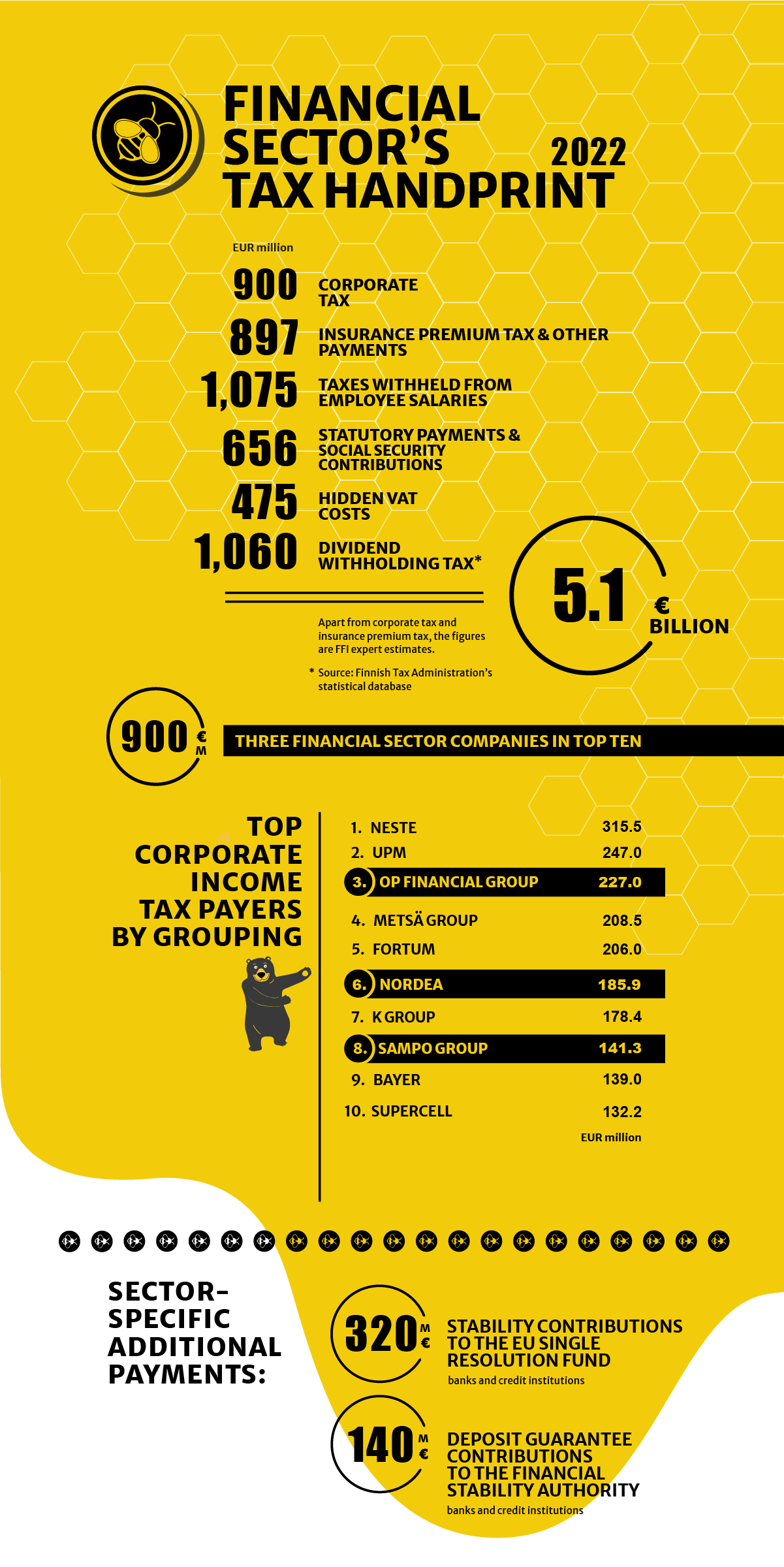

- Financial sector companies paid €900 million in corporate income tax.

- The sector’s total tax handprint grew from €4.8 billion to €5.1 billion.

The top ten payers of corporate tax included three financial sector companies: OP Financial Group, Nordea and Sampo Group.

“Our member companies’ top positions in the tax statistics serve as a good reminder that banks and insurers have long been among the biggest taxpayers and financiers of the Finnish welfare society. The corporate taxes paid by financial sector companies amounted to 11.2% of all corporate tax in Finland. This speaks firmly against the claims that the sector is undertaxed”, Finance Finland’s CEO Arno Ahosniemi comments.

Finland’s top corporate taxpayer in 2022 was the oil and gas giant Neste (€315.5 million), followed by forest industry corporation UPM-Kymmene (€247 million) and OP Financial Group (€227 million). In the financial sector, the top payers after OP Financial Group were Nordea (€185.9 million, 6th), Sampo Group (€141.3 million, 8th), Danske Bank (€48.6 million) and LocalTapiola Group (€46.4 million).

Finance Finland compiled the financial sector data based on public information provided by the Finnish Tax Administration. Other sectors’ figures have also been calculated at group level.

The taxes paid by financial sector companies would cover the entire budget for upper secondary and tertiary education and university research

The taxes paid by financial sector companies would cover the government budget for university-level education, university research and vocational and general upper secondary education. The budget allotted to these in 2023 is €4.9 billion.

The tax handprint for the sector is calculated from its corporate income tax (€900 million), insurance premium tax (€875 million) and contributions towards fire protection, road safety and industrial safety (€22 million). The sector also generates employee income tax (€1,075 million), social security contributions (€656 million) and dividend withholding tax (€1,060 million), and pays hidden VAT costs of €475 million.

Strong banks support growth

The recent climb in interest rates has reflected on banks’ net interest income and improved their performance. As usual, they have been subject to a substantial amount of taxes – but are banks’ profits really as big as they appear to be?

A comparison of the profitability of Finnish banks and other sectors reveals that against common conception, the banking sector’s profitability does not stand out as particularly great. In 2018–2022, for example, credit institutions’ return on equity averaged between 5% and 10%, when the performance of Finland’s most profitable companies reached well above 30%.

“The profitability of banking is a positive thing for the Finnish economy: a financially stable banking sector is able to finance investment, promote growth and drive the green transition, thus contributing to the welfare of society. Banks’ strong performance naturally also increases the sector’s tax handprint”, points out Ahosniemi.

Minimum tax: Much expensive ado about nothing?

Finland is preparing draft legislation on the implementation of the EU Minimum Tax Directive. The directive requires member states to ensure that their effective tax rate is at least 15%. The global minimum tax rules apply to all groups and companies whose annual revenues are at or above €750 million.

The EU directive on minimum taxation was published in 2022, and member states are now transposing it into their national legislation. The tax rate in Finland is already so high and the tax base so extensive that a minimum tax is highly unlikely to bring any additional tax revenue for Finland. Instead, all the reporting that it necessitates will cause much additional work and costs in the companies’ tax, accounting and IT departments.

Finnish authorities have not had the time or the resources to prepare sufficient guidelines on the reporting, either.

“Companies are asked to commit expensive resources into analysis and reporting that is essentially based on guesswork due to the lack of guidelines and the complexity of regulation. In the worst case, they may even end up with sanctions for incorrect reporting. And after all this, the state will not even gain any more tax revenue because Finland’s tax rate was already high enough. The reform is not only expensive and burdensome but also useless”, Ahosniemi says.

VAT exemption is not always an advantage

The financial sector’s hidden VAT costs amounted to approximately €475 million in 2022. In accordance with the EU VAT directive, financing and insurance services are exempt from value added tax. This exemption is based on difficulties in defining the tax base, problems with technical implementation and reasons of international competition.

Unlike most companies, financial sector companies cannot deduct the VAT for the goods and services they purchase. The sector thus bears a hidden VAT burden compared to companies that sell services subject to VAT.

Finance Finland estimated in 2020 that this hidden VAT amounted to approximately €450 million. This estimate has now been updated to match the general increase in the prices of goods and services.

Sector-specific additional payments totalled €460 million

In addition to the national taxes and contributions, credit institutions pay stability contributions to the EU Single Resolution Fund. In 2022, the Financial Stability Authority collected a total of €320 million in stability contributions from Finnish credit institutions. Credit institutions and banks also paid a total of €140 million in deposit guarantee contributions to the Financial Stability Authority.

Sources used in the calculation of the sector’s tax handprint: Finnish Tax Administration, Statistics Finland, companies’ financial statements, KPMG, Finance Finland.

Looking for more?

Other articles on the topic

Financial sector’s VAT treatment needs an overhaul, but the Finnish pension system must not be hampered with added tax burden

The Nordic financial sector calls for harmonised implementation of the FASTER Directive

Income taxes paid by financial sector companies grew to €1.3 billion in 2023, and the sector’s total tax handprint of €5.6 billion would cover Finland’s military expenditure – OP Financial Group and Nordea the two largest taxpayers in Finland

Finance Finland proposes ways to increase economic growth and tax revenue: Finnish law must provide for retail ELTIFs