- The increase in digital scams continued during 2022 and Finns lost a total of EUR 32.4 million to fraudsters.

- Watch out, verify, warn others – a joint campaign by Finnish authorities, NGOs and companies – makes the point that everyone can help prevent scams.

The campaign Watch out, verify, warn others is a joint campaign from Finnish authorities, NGOs and a number of companies. The project partners are Finance Finland, the police, the Consumers’ Union of Finland, the Cyber Security Centre at the Finnish Transport and Communications Agency, Kela, the Digital and Population Data Services Agency, Aktia, Danske Bank, DNA, Elisa, Handelsbanken, Nordea, Oma Säästöpankki, OP Financial Group, POP Bank, S-Bank, Savings Banks Group, Telia and Microsoft.

The aim of the campaign is to prevent digital scams by raising awareness among people in Finland and providing information on how to protect against scams. The campaign’s hashtag is #WatchOutVerifyWarnOthers.

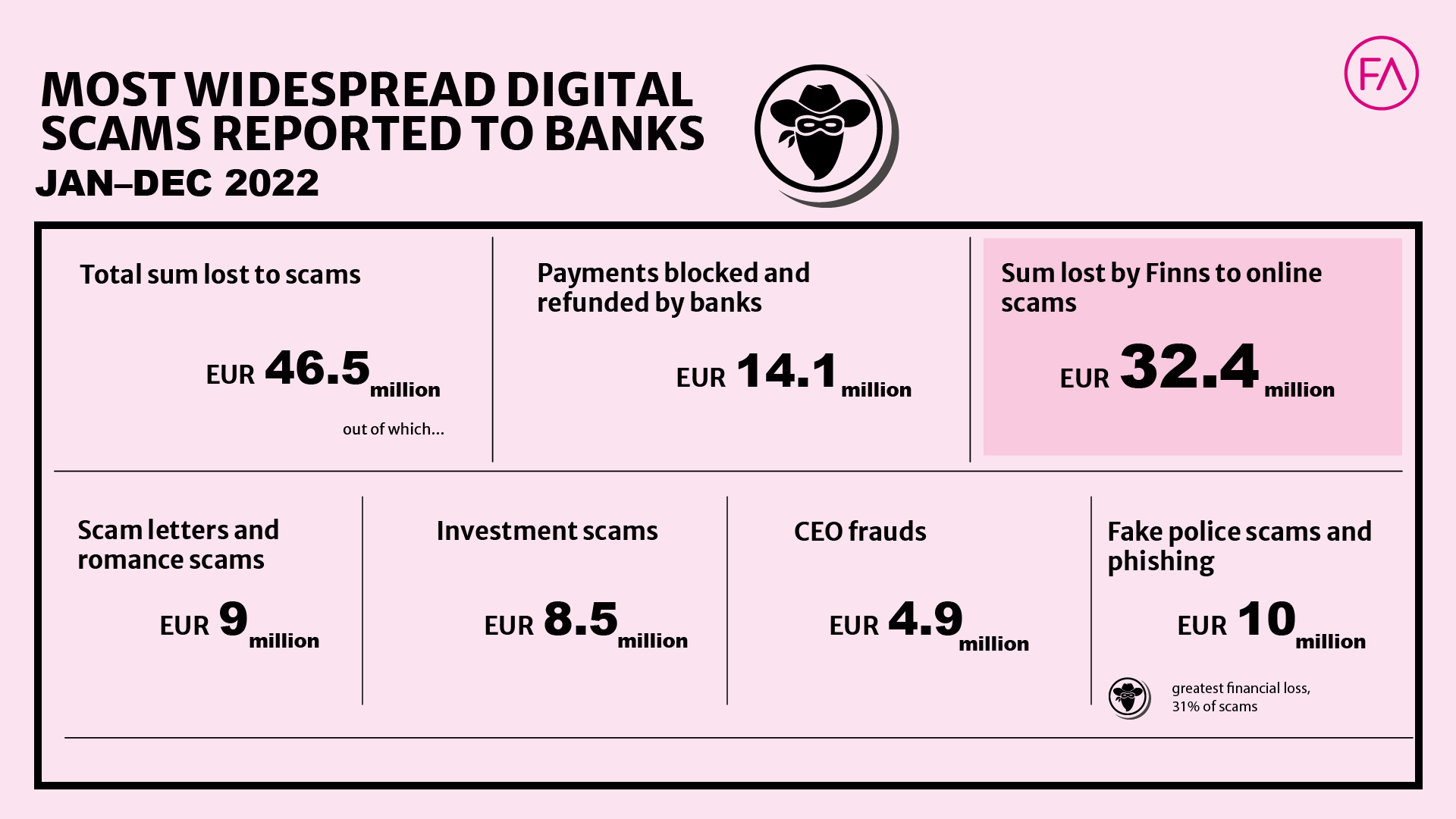

Digital scams are a widespread problem and warnings have been issued for many years. Despite that, online scams continue to increase.Every year, several thousand offences linked with digital scams are reported to the police. Information from banks shows that Finns lost a total of EUR 32.4 million to fraudsters in 2022. The sum lost might have been a great deal higher if banks and authorities had not prevented a total of EUR 14.5 million from being transferred into the hands of fraudsters. Instead, the recovered money was returned to its rightful owners. The campaign Watch out, verify, warn others – a joint venture from authorities, NGOs and companies in Finland – underlines that everyone in Finland can help to counteract and prevent scams.

In 2022, the sums lost by Finns included a total of EUR 9 million to scam letters and romance scams, EUR 4.9 million to CEO frauds and EUR 8.5 million to investment scams. The biggest sums, a total of EUR 10 million, were lost to fake police scams and various types of phishing. Monetary losses to scams in these categories were almost four times higher in July–December than they had been in January–June 2022. More money was also lost to other types of scams in July–December.

Always report a scam

Bank statistics on scams do not include all types of scams. Moreover, statistics do not show cases where the victim chooses not to report the scam to their bank or to report it as a crime to the police. There is no clear information on the number of unreported cases or on the criminal gains from them. One of the messages of the campaign Watch out, verify, warn others is that anyone can fall prey to a scam. There is no need to feel embarrassed about it; the important thing is to take action quickly. Always report a scam to your bank and to the police.

Contact your bank immediately if you suspect that you may have transferred money to a scam account or that your online bank codes are in the wrong hands. Cancel your cards if your bank or credit card details have fallen into the wrong hands. Then report the crime to the police.

Seek help and support

When you fall prey to a scam, your losses are not just financial. It is only natural to blame yourself and feel helpless and so embarrassed that you feel unable to tell even the people closest to you.

Recognise the scam and warn others

Scams happen constantly and keep changing, but it is possible to protect yourself from them. The campaign Watch out, verify, warn others offers the following easy-to-remember tips:

- Watch out for messages and other unexpected contact attempts that contain links or tell you that you have to do something.

- Verify that the messages really come from the person or organisation that they seem to come from. Sign in to online services via a secure route: enter the direct address of the service in the browser address bar or go to the service via a bookmark you have saved. Do not click on links provided by search engines. If the service can be used with an app made for it, use the app.

- Warn others about scams, too: tell your friends, family and co-workers. File a report of an offence to the police and also report scams to The National Cyber Security Centre at the Finnish Transport and Communications Agency.

If you become a victim of a scam it is important to seek help and support: tell your loved ones and do not hesitate to seek professional help if you feel you need it. Victim Support Finland is one of the organisations that provide help. Keep in mind that being scammed was not a choice you made.

If an offer sounds too good to be true, then it probably isn’t true

The most important rule to remember is to treat all messages with a healthy suspicion. Something that sounds too good to be true usually isn’t true. You should also be suspicious if there is urgency or time pressure involved. Scammers very often try to hurry you into making quick decisions by, for example, saying that a great offer will expire soon or that you must immediately do something that is very important.

Scammers are always trying to get money or the kind of information that they can use for financial crimes. Keep in mind that your personal online banking codes and your bank and credit card information are only for your own use. Do not give that information to anyone else in any communication channel or online service, if you are not completely sure that the service is legitimate. Scammers pose as banks, authorities and other legitimate contacts when they go phishing for information using email, SMS and instant messaging, social media, phone calls and search engines. It is important to remember that your bank or the authorities will never ask for your online banking codes or your bank and credit card information, not even when you meet them face-to-face.

Read more

Still have questions?

|Contact FFI experts

Looking for more?

Other articles on the topic

Finnish financial sector and authorities tested their ability to operate under severe disruptions and emergency conditions

Fraud must be tackled at the source – Social media platforms and online marketplaces need to be involved in fraud prevention

Volume of digital fraud skyrockets in Finland – Banks blocked more than €44 million’s worth of fraud-related payments in 2024

The Commission must tighten the screw on fraud prevention – Social media platforms and online marketplaces must also be involved