- Executive Chair of Finance Finland’s Board of Directors Sara Mella petitions the Finnish government to overturn the planned measures that undermine pension saving.

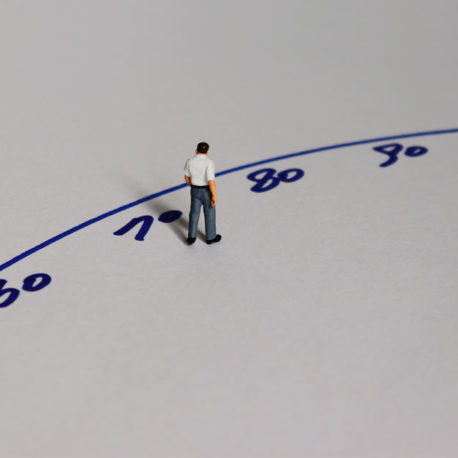

- Less than a third of all Finns believe that their statutory pension will be enough to cover all the services they will need if they live to be over 80, reveals a public opinion survey commissioned from Norstat by Finance Finland. The survey was conducted in December and drew responses from more than 2,000 people.

- According to Mella, the government must back-pedal on its decision to discontinue the tax subsidy for voluntary pension savings, taken in its spending limits session.

Executive Chair of Finance Finland’s Board of Directors and Head of Personal Banking in the Nordic region at Nordea Sara Mella appeals to the Finnish government not to undermine voluntary pension saving any further. She hopes that the government will overturn its decision to discontinue the tax subsidies for voluntary pension saving and long-term savings accounts.

“Voluntary pension saving improves pensioners’ financial security and quality of life. It can also promote retail saving, investment and opportunities for wealth creation, which is important in terms of economic growth as well”, Mella stresses.

Only about 28% of Finns believe that their statutory pension will be enough to cover all the services they will need if they live to be over 80. This concern was revealed in a recent public opinion survey commissioned from Norstat by Finance Finland.

“The concern is not unfounded. Although we have a good statutory earnings-related pension system that guarantees a basic income for pensioners, statutory pension alone may not be enough to cover all their retirement needs. For one thing, pensioners have more free time on their hands, which often increases spending. But pensioners typically also experience rapidly increasing healthcare and care service costs”, Mella points out.

Mella hopes that the government will respond to the concerns Finns have about being able to make ends meet by giving pension saving the value it deserves.

“Statutory pension coverage should be complemented with voluntary pension saving, giving pensioners more freedom in their personal finances.”

Mella criticises the government’s decision to remove the tax subsidies for voluntary pension savings.

The decision threatens to pull the rug from under the feet of the 400,000 Finns who still have voluntary pension insurance or a long-term savings account. At the moment, Finns can deduct up to 5,000 euros of the annual contributions they pay for either voluntary pension insurance or a long-term savings contract. If the tax incentive is removed, there is a risk that Finns will no longer be motivated to tie up their savings until they retire. This could effectively end voluntary pension saving.

The decision to discontinue the tax subsidies for voluntary pension insurance and long-term savings contracts represents a complete U-turn from the government’s earlier position to promote saving, investment and wealth creation. The government has since promised to look into incentivising voluntary pension saving.

Looking for more?

Other articles on the topic

Less than a third of Finns believe they can live on statutory pension alone – Chair of Finance Finland’s Board Sara Mella: Pension saving also supports economic growth

Finland back in the top five in international pension comparison – ranked the most transparent and reliable pension system in the world

Europe promotes pension saving – why is Finland lagging behind?

Finland once again among the top ten pension systems