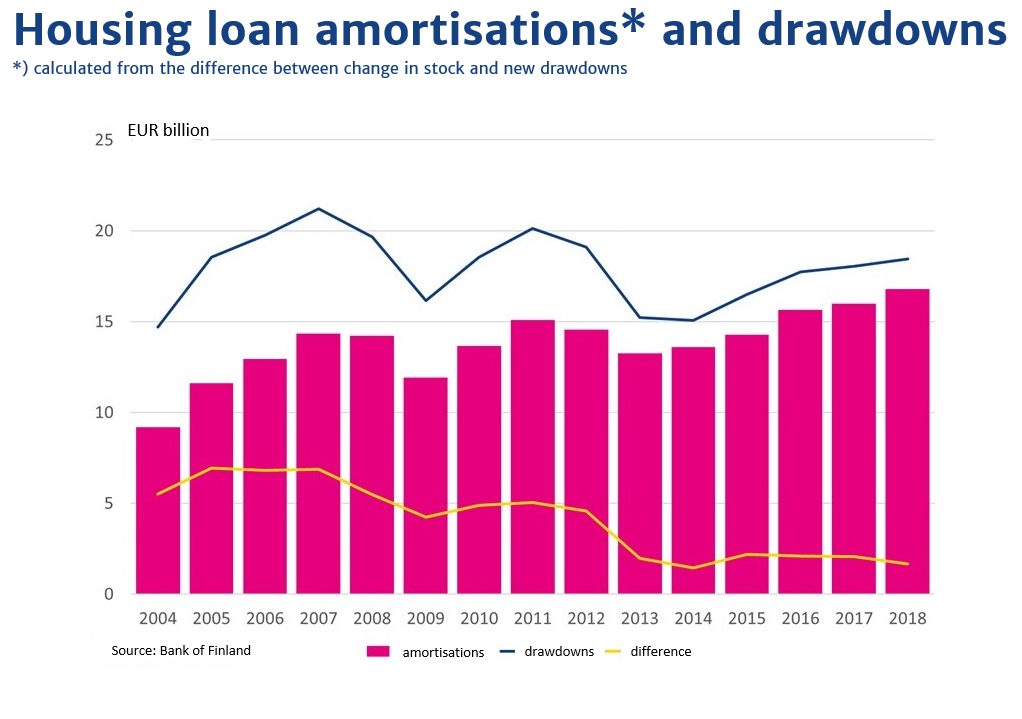

Finns broke all previous records by making nearly €17 billion’s worth of

home loan repayments last year. As

interest rates fell in 2018, the instalments of loans with annuity-based

amortisation had larger proportions of principal. The

Finnish housing loan stock stood close to €98 billion at the end of November.

”This surge in amortisations is not a sign of sudden enthusiasm among households to pay off their housing loans,” assures Elina Erkkilä, head of statistical and supervisory reporting at Finance Finland.

”The interest rates of new housing loans have been falling every month, and the average interest rate of the housing loan stock also fell in 2018. However, the decrease seems to be settling down now. When the proportion of interest in the monthly instalment is small, the proportion of loan principal is that much larger for those households that have an annuity-based amortisation plan,” Erkkilä explains.

The new drawdowns of households’ and businesses’ bank loans have grown at the moderate rate of about three percent. The housing market’s price development has also remained moderate. Finland has nevertheless implemented most of the macro-prudential tools defined in legislation, such as banks’ additional capital requirements and a maximum loan-cap ratio on housing loans.

”Before considering any further tightening measures, we need to carefully assess how these earlier decisions affect the housing loan market and the economy in general to avoid surprises later on. The availability of workforce could suffer if households cannot afford to move to where the jobs are,” Erkkilä says.

For several years now, the housing loan portfolio’s growth has been slowing down. The faster rate of amortisation has a decelerating effect on annual growth, which fell to 1.7 percent by the end of 2018. The volume of housing loan amortisations is calculated from the difference between the increase of the stock and new drawdowns.