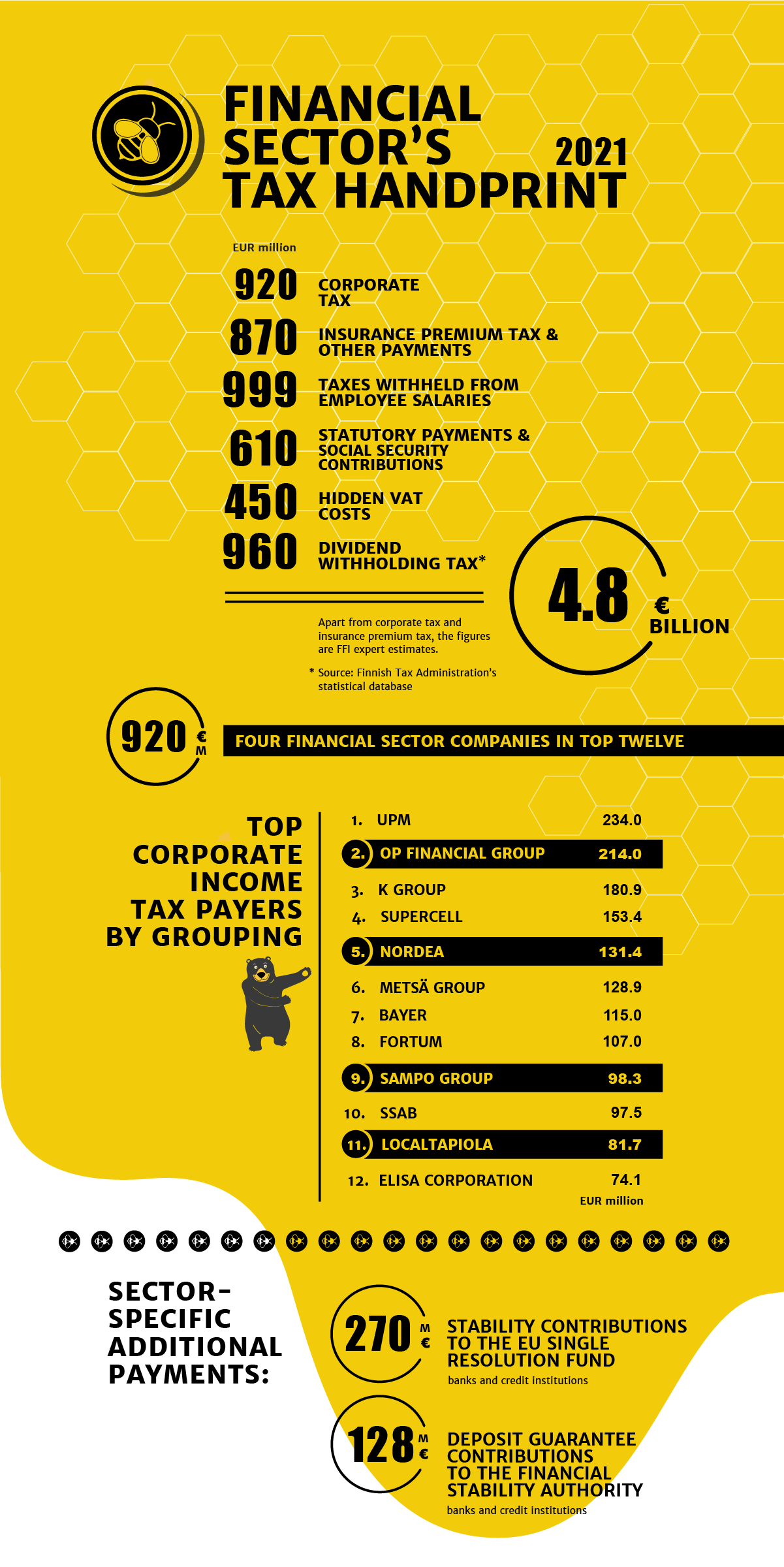

The financial sector’s total tax handprint in 2021 was about €4.8 billion. The sector pays corporate income tax (€920 million), insurance premium tax (€848 million) and contributions towards fire protection, road safety and industrial safety (€22 million). Moreover, the sector generates employee income tax (€999 million), social security contributions (€610 million) and dividend withholding tax (€960 million) and pays hidden VAT costs of €450 million.

The financial sector was once again one of the biggest taxpayers in Finland according to 2021 tax data released by the Tax Administration. In total, the sector paid €920 million in corporate tax, which amounts to more than 12% of all corporate tax in Finland and is about €357 million more than in 2020. The top twelve payers of corporate tax included four financial sector companies: OP Financial Group, Nordea, Sampo Group and LocalTapiola Group.

“Our member companies’ top positions in the tax statistics are a good reminder that banks and insurers have long been among the biggest taxpayers and financiers of the Finnish welfare society. But taxation has its limits. The financial sector’s ability to provide financing, insurance and investment options to households and businesses will be at risk if the sector is burdened with new taxes. Sector-specific taxes, for example, would weaken the Finnish sector’s competitiveness and raise costs for customers”, emphasises Piia-Noora Kauppi, managing director at Finance Finland.

Different kinds of financial transaction taxes would directly affect the costs of employees and work. A tax levied on payrolls would encourage the automation or offshoring of certain tasks.

The idea of introducing new taxes in the financial sector is not supported by political decision-makers, either: in a recent decision-maker survey by Aula Research, 72% of the respondents either fully or somewhat agreed with the statement “Finland should not implement financial sector-specific national taxes that could weaken the sector’s competitiveness and raise costs for customers”. The survey was commissioned by Finance Finland and carried out in August and September.

The amount of the dividend withholding tax is based on statistics compiled by the Tax Administration. Apart from corporate income tax and insurance premium tax, the other figures are estimates by Finance Finland’s experts.

Enough to fund all child benefits for three years

The Finnish financial sector’s tax handprint increased by €1.2 billion from 2020. The total amount of taxes paid by the financial sector – a whopping €4.8 billion – is enough to cover the entire country’s child benefits for more than three years.

“The corporate taxes paid by financial sector companies amounted to more than 12% of all corporate tax in Finland. The financial services sector not only finances households and businesses and acts as a long-term investor and insurer of risks, but it is also one of the pillars of society in funding public welfare”, points out Kauppi.

Finland’s top corporate tax payer in 2021 was the forest industry company UPM-Kymmene (€234 million), followed by OP Financial Group (€214 million) and retailing conglomerate K Group (€180.9 million). In the financial sector, the top payers after OP Financial Group were Nordea (€131.4 million, 5th), Sampo Group (€98.3 million, 9th) and LocalTapiola (€81.7 million, 11th).

Finance Finland compiled the financial sector data based on public information provided by the Finnish Tax Administration. Other sectors’ figures have also been calculated at group level.

Hidden VAT costs estimated to reach €450 million

In accordance with the EU VAT directive, financing and insurance services are exempt from value added tax. This exemption is based on difficulties in defining the tax base, problems with technical implementation and reasons of international competition.

Unlike most companies, financial sector companies cannot deduct the VAT for the goods and services they purchase. The sector thus bears a hidden VAT burden compared to companies that sell services which are subject to VAT. Finance Finland estimated in 2020 that this VAT amounted to approximately €450 million. This estimate is valid also in 2021.

“The non-deductible VAT raises prices especially to corporate customers, who cannot deduct VAT from the financial services they purchase. The tax exemption mainly benefits retail customers in the form of lower retail prices. The claim that the VAT exemption causes the sector to be undertaxed is false”, says Kauppi.

Nearly €400 million in sector-specific additional payments

In addition to the national taxes and contributions, credit institutions pay stability contributions to the EU Single Resolution Fund. In 2021, the Financial Stability Authority collected a total of €270 million in stability contributions from Finnish credit institutions. Credit institutions and banks also paid a total of €128 million in deposit guarantee contributions to the Financial Stability Authority.

Sources used in the calculation of the sector’s tax handprint: Finnish Tax Administration, Statistics Finland, companies’ financial statements, KPMG, Finance Finland.

Looking for more?

Other articles on the topic

Financial sector’s VAT treatment needs an overhaul, but the Finnish pension system must not be hampered with added tax burden

The Nordic financial sector calls for harmonised implementation of the FASTER Directive

Income taxes paid by financial sector companies grew to €1.3 billion in 2023, and the sector’s total tax handprint of €5.6 billion would cover Finland’s military expenditure – OP Financial Group and Nordea the two largest taxpayers in Finland

Finance Finland proposes ways to increase economic growth and tax revenue: Finnish law must provide for retail ELTIFs